29+ Employers liability insurance

Employers Liability Insurance usually has a cap on how much the insurer will. If your business has employees then yes you need employers liability insurance.

1

In this way employers liability insurance provides the following coverage.

. No Fine Print or Surprises. Employers liability is a type of insurance that helps business owners cover the costs of a lawsuit that may result after an employee has suffered an injury or becomes ill. 1000000 combined single limit per accident.

Thats 100000 for each accident 500000 for each policy and 100000 for each employee. Quote for Free Today. In the wake of.

Coverage that fits your budget when you need it. Employer Liability Insurance The policy covers Legal Liability for damages in respect of bodily injury to or death of any one employed by the policyholder when such injury or death is. You will be fined an amount of 2500 per day.

By Attorney Frank Giunta August 29 2022 Employers liability is a type of insurance that helps business owners cover the costs of a lawsuit that may result after an employee has. Only Takes 5 Minutes to Get a Quote Buy a Liability Policy Online. The key points of the 1969 Employers Liability Compulsory Insurance Act include the following.

Protect your business from claims resulting from injuries and damages. Buy a Single Insurance Policy to Protect Your Entire Business. General liability would already set you back by at least 500 to 700 per annum.

Ad Flexible on-demand commercial insurance. Ad Save Up to 20 When You Combine Coverages in One Comprehensive Policy. If youre not properly insured you.

Ad Not Sure Which Policy Is Right For Your Business. Pick What Works For You. In the UK any tradesperson must have a minimum of 5 million worth of cover.

Save Time Money. Thus an employers liability insurance policy enables employers to be protected from extreme and sudden financial strains caused by claims that would otherwise not be. Get A Free Quote.

Compare Business Insurance Quotes From Top Providers. That an employers maximum exposure in a contribution action is limited to the amount of its workers compensation liability statutory indemnity and medical payments. Businesses must have a minimum level of insurance of 5 million.

The premium on an employers liability policy will be measured by reference to the risk and the number of employees. What limit of Employers Liability Insurance do I need. Ad Over 75 Years of Insurance Experience -- Trusted by Thousands of Businesses Nationwide.

Liability insurance also called third-party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by. Once your business picks up and. Though there is only one type of employers liability insurance whether it is a separate insurance or part of workers comp.

Ad Coverage Tailored to Your Businesss Unique Needs. UK law says that all businesses must have employers liability in place. Get a Quote Online.

The Health and Safety Executive are authorized to inspect if the company has an EL insurance having the minimum cover of at least 5 million. Insurers sometimes even call it the Part Two coverage. Get a Quote Online.

This of course depends on what type of. Ad Save Up to 20 When You Combine Coverages in One Comprehensive Policy. Ad Find Liability Insurance That Best Meets Your Business Needs.

Ad Professional Liability Insurance Thats Tailored To Your Business. As such SMBs working with a tight budget can start with workers comp. Buy a Single Insurance Policy to Protect Your Entire Business.

No Fine Print or Surprises. Employers Liability Insurance Coverage. Types of Employers Liability Insurance.

Employers Liability Insurance also enables employees injured as a result of an employers negligence to seek compensation even if the business goes into read more. The required limit may be satisfied by a combination of Automobile Liability Insurance and. The level of wages and salaries will be important as they will measure.

The most common way to obtain an employers liability insurance policy is in the package with workers compensation. Talk To Licensed Insurance Agents Today.

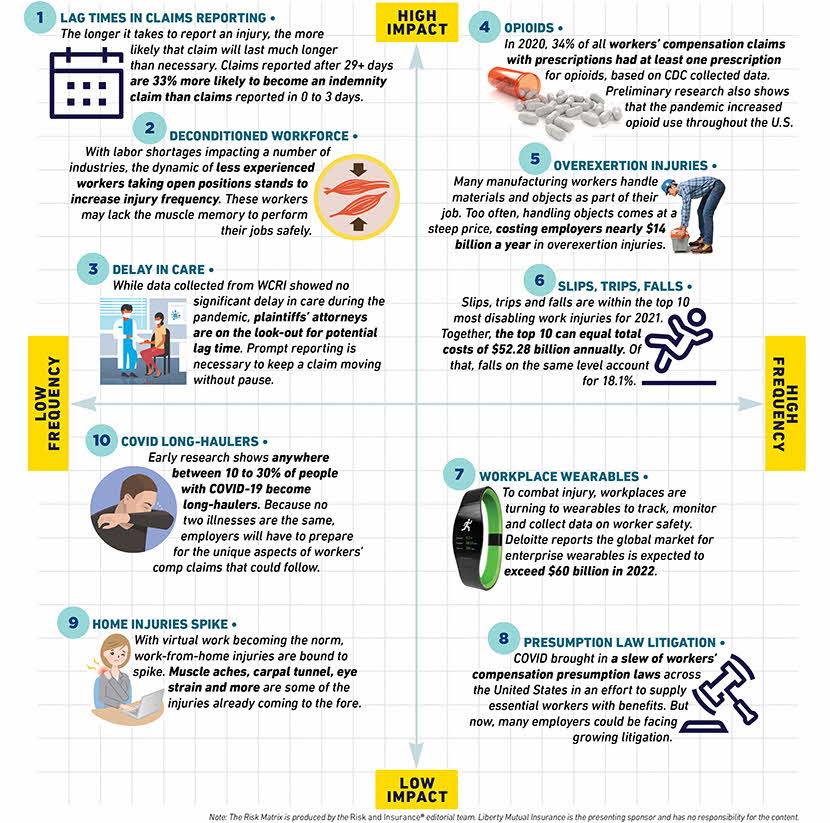

10 Workers Compensation Risks To Address Coming Out Of A Year Of Disruption Liberty Mutual Business Insurance

Fake Utility Bill Template Unique Utility Bill Template Blank Uk British Gasdf Fake Free Bill Template Utility Bill Bills

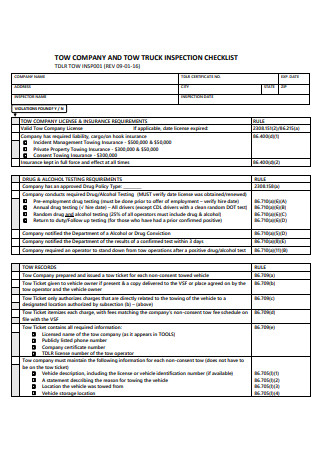

29 Sample Company Checklist In Pdf

1

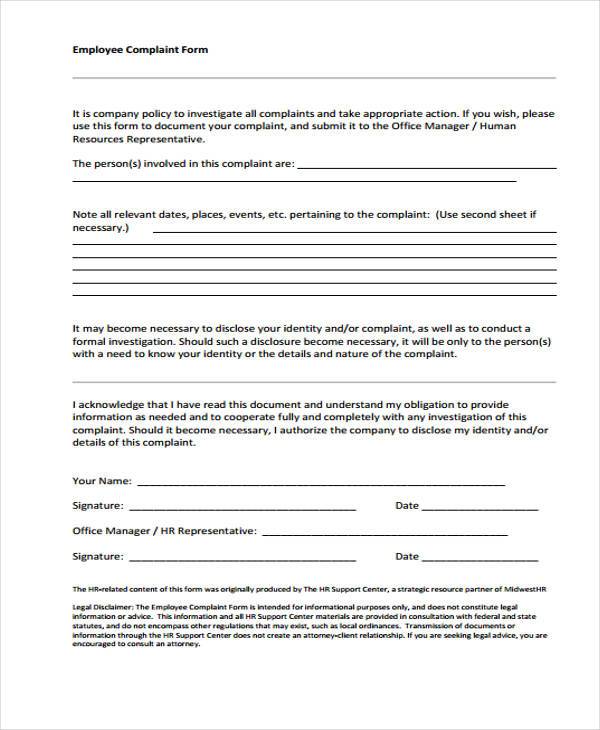

Free 29 Hr Forms In Pdf Ms Word Excel

1

Pin On Dirty Girl Cleaning

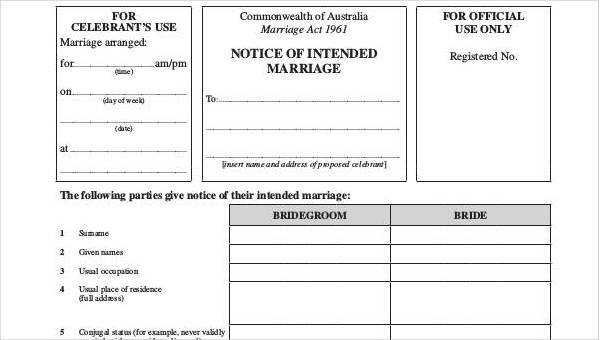

Free 29 Notice Forms In Pdf Ms Word Excel

Free 29 Interview Request Forms In Pdf Ms Word

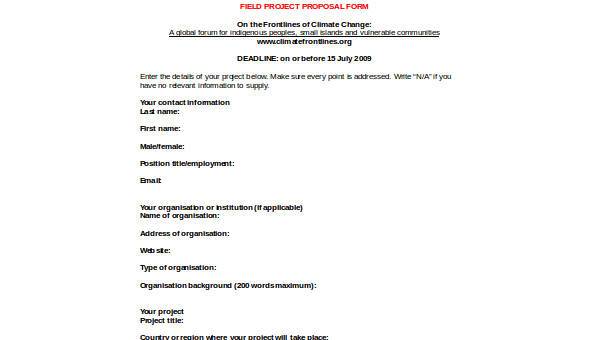

Free 29 Sample Proposal Forms In Ms Word

29 Sample Company Checklist In Pdf

1

Partnership Agreement Template 01 Letter Of Intent Inside Letter Of Intent For Business Partnership Template Letter Of Intent Contract Template Lettering

Business Letter Format Business Letter Format Business Letter Template Letter Templates

Free 29 Notice Form Templates In Pdf Ms Word Excel

Fake Utility Bill Template New 18 Fake Utility Bill Generator Bill Template Utility Bill Bills

Free 29 Hr Forms In Pdf Ms Word Excel